Risk Manager Job Details: Roles, Qualification, Responsibility, Salary and Scope

Do you pay close attention to mistakes that could be made and put the organization’s safety, security, and overall goals at risk? You might be the next great manager who can keep an eye on the company’s risks and make sure that daily losses have as little of an effect as possible. To do this, you need to be very good at running a business, solving problems, making plans, and working with others. On average, a Risk Manager can make INR 12–17 LPA a year.

This blog is helpful if you want to be the next risk manager and think you’d be great at the job. We’re going to talk about the newest roles and responsibilities, salaries, and requirements to become a Risk manager at the best staffing firms. Here are some of the best tips and tricks that recruiters have told us.

About Risk Manager

As a risk manager, it is your responsibility to continually look at risks, find ways to reduce them, and figure out which risks could affect how an organisation works. In this job, you’ll be putting risk management plans into action, making sure that laws are followed, and coming up with backup plans for when things go wrong.

A risk manager would also be in charge of creating and maintaining risk profiles up to date, doing periodic risk evaluations, and educating employees about risk management principles. Also, consistent interaction to stakeholders is necessary to keep them up to date on the organization’s efforts to reduce risk and its exposure to risk.

In order to sum up, a risk manager’s job is to protect the company’s assets and make sure business keeps going by actively handling risks. You would be in charge of many things, including keeping an eye on the accomplishments, managing the eros, and making sure the organisation moves forward.

These are all the tips and tricks we know to help you become the next great Risk Manager at the best companies that hire.

Step to Become a Risk Manager

Get your bachelor’s degree. You need to have at least a bachelor’s degree in a marketing-related subject, like economics, finance, or business administration.

Get experience in the field. To be a Risk Manager, you need at least two to three years of experience in the field.

Go with the Right Certification: You can also take a certification course to demonstrate on your skills and improve your probabilities of becoming a Risk Manager. The extra stars come from taking a certification course, like the Risk Management Society’s Certified Risk Management Professional (RIMS-CRMP) or the Certified Risk Manager (CRM).

Keep your skills up to date: Keep up with the job market. Continue to add new skills to your CV and stay up to date on the latest ways to improve your skills.

Also read– Trending Job roles for MBA Degree holder

Qualification

All college graduates can work in this field, but if you have a degree in one of the following, your chances may be better:

| Accounting | IT |

| Engineering | Law |

| Finance or Economics | Management or Business Studies |

| Mathematics | Risk Management |

| Science | Statistics |

The Roles and Responsibilities of Risk Manager

| Roles | Responsibilities |

|---|---|

| You have to find possible risks that might harm the business. | For maximum risk control, you would be in charge of making backup plans. |

| You would teach senior management and other important people how to manage risks. | You would keep an eye on existing risk management plans, guess how well they work, and make any changes that are needed. |

| You would be in charge of making sure the company follows all laws and rules about risk management. | You would look into market trends and use what you learn to improve how the company manages risk. |

| You would create and set up a risk management system that fits the needs of the business and protects the investments of all stakeholders. | For solid risk management plans, you need detailed investigations and assessments. |

Skills of a Risk Manager

| Skill 1 | Skill 2 |

|---|---|

| Analytical skills | Technical understanding |

| Communication, interpersonal and presentation skills | Proactive approach |

| An eye for details | Commercial awareness |

| Decision-making and problem-solving skills | Leadership qualities |

| Organisation and planning skills | Numerical abilities |

| Resilience and ability to handle pressure at work | A great team player |

| Promptness |

Top Organizations and Area of Risk Management

| Banks and wealth management organisations | Hospitals and care providers |

| Central and local governments | Technology risk |

| Auditing and consulting firms | Insurance risk |

Corporate governance | Transport industries |

| Engineering companies | Logistics companies |

Top Hiring Companies

| Amazon | HSBC |

| Deloitte | PayPal |

| EY | Wells Fargo |

| Accenture | Credit Suisse |

Risk Manager Salary in India

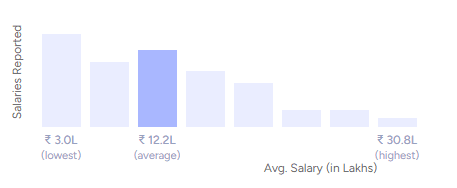

There are different pay packages for Risk Managers in India based on their skills, experience, location, and other factors. An average risk manager in India makes INR 12.2 lakh a year, which is between 3 lakh and 30 lakh. The salary estimates come from the most recent 2,000 salaries submitted in by Risk Managers. These ranges of salaries can change based on your experience, skills, location, and the company you work for.

Also check- University ROI Calculator

Salaries in other departments

Finance & Accounting

Data Analyst Salary

2 - 14 years exp. (436 salaries)

₹14 Lakhs

₹4 L/yr - ₹25.2 L/yr

BFSI, Investments & Trading

Customer Service Manager Salary

2 - 14 years exp. (99 salaries)

₹11.2 Lakhs

₹3 L/yr - ₹30.5 L/yr

Data Science & Analytics

Compliance Officer Salary

2 - 14 years exp. (412 salaries)

₹12.5 Lakhs

₹3 L/yr - ₹30.5 L/yr

Risk Management & Compliance

Finance Manager Salary

2 - 14 years exp. (71 salaries)

₹10.8 Lakhs

₹3 L/yr - ₹30 L/yr

Customer Success, Service & Operations

Risk Manager Salary

2 - 14 years exp. (339 salaries)

₹13.4 Lakhs

₹3 L/yr - ₹25.2 L/yr

Career Scope

Graduate training or risk technician/analyst entry are common ways to enter risk management. With experience, you can become a risk manager and then a CRO after ten years.

As more companies appoint CROs to boards, career development opportunities increase. Restructuring and risk-taking are also departmental strategies.

Risk managers have great flexibility in transferring their skills and experience across sectors. Transferring sectors can lead to higher salaries, better prospects, and sponsored education.

Conclusion

The risk manager is in charge of many things, such as managing safety and security risks and making sure that the policy is implemented. Just get a bachelor’s degree and work as a Risk Manager for a few years. The job is perfect for people who can solve problems, make quick decisions, plan strategically, and work well with others. This job is perfect for you if you want to make between INR 8.5 LPA and INR 12.3 LPA a year. You can add the most recent Risk, security, and safety management certifications, skill-building workshops, and relevant projects to your CV. Best of luck!